Introduction:

As part of the Asian Women Index, in collaboration with Illuminate Asia, this study delves into the favourite chicken brands across five major cities, uncovering the factors that make these brands stand out. Conducted in October and November 2023, the research engaged over 1,500 individuals to examine not only the most popular chicken brands but also the reasons behind their appeal. Beyond identifying overall preferences, the study explores how these preferences vary across cities, gender, and age groups, offering a comprehensive view of consumer behaviour and brand loyalty in the region.

By analysing the motivations of different demographic segments, this study provides valuable insights into what drives consumers to choose one brand over another—whether it’s menu variety, taste, convenience, or promotions. Here we dive into the findings, starting with how brand preferences shift across age groups and the factors that shape these choices.

Research findings:

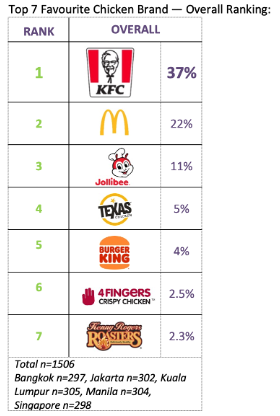

When it comes to favourite chicken brands in Southeast Asian markets, KFC takes the crown with an impressive 37% of respondents naming it their top choice across 33 chicken brands in five cities. McDonald’s follows as the second favourite with 22%, while Jollibee secures the third spot with 11%. Texas Chicken (5%) and Burger King (4%) round out the top five, though their popularity falls significantly short of the top two contenders.

Interestingly, Jollibee’s strong performance is particularly notable given its availability is limited to just Manila, Kuala Lumpur, and Singapore. Its immense popularity in Manila alone drives its third-place ranking, highlighting the brand’s significant local appeal.

Below is a breakdown of these findings, illustrating the clear dominance of KFC and McDonald’s in the chicken brand category.

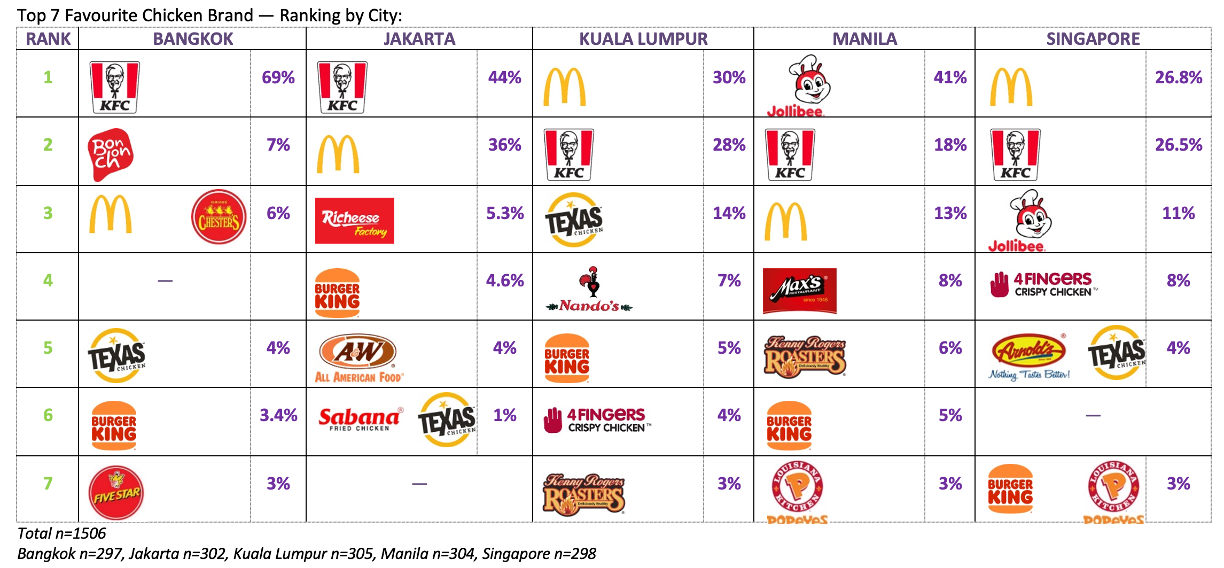

City-Specific Preferences: The popularity of chicken brands varies notably across the five cities surveyed, reflecting local tastes and brand loyalties.

- Bangkok and Jakarta stand out as strongholds for KFC, with 69% of Bangkok residents and 44% of Jakarta residents naming it their favourite chicken brand.

- Kuala Lumpur and Singapore present a more divided picture. In these cities, McDonald’s and KFC are neck-and-neck in popularity. In Kuala Lumpur, McDonald’s is preferred by 30% of respondents, just slightly behind KFC at 28%. Similarly, in Singapore, McDonald’s edges ahead with 26.8% favouring it, while KFC is close behind at 26.5%.

- In Manila, the dominance of the homegrown Jollibee is unsurprising, as it captures a commanding 41% share. KFC follows in a distant second place at 18%, underscoring the strong national pride associated with Jollibee in the Philippines.

These city-specific insights reveal the varying dynamics of brand preference, shaped by both global and local influences. A breakdown of these differences is highlighted in the chart below.

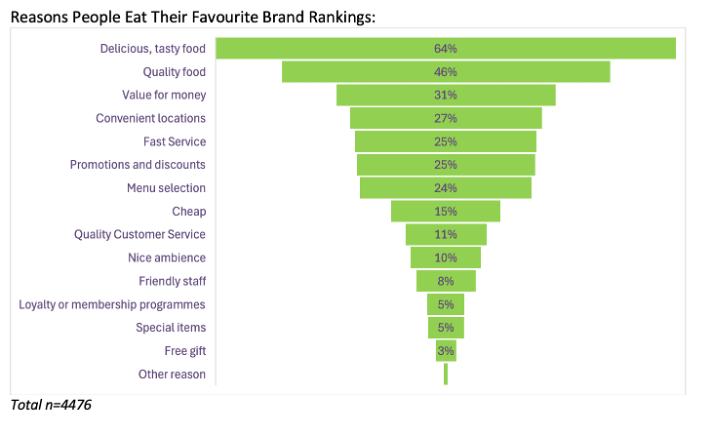

What Drives Chicken Brand Preferences? When choosing their favourite chicken brands, consumers prioritize taste and quality above all else - respondents were asked to select three key reasons out of fifteen that influenced their brand preferences.

- Leading the list, a substantial 64% of respondents cited delicious, tasty food as the top reason for their choice

- Quality food followed closely as the second most important factor, selected by 46% of respondents, while value for money ranked third at 31%.

- Convenience also plays a role, with 27% highlighting convenient locations as a factor, and 25% mentioning fast service. Interestingly, promotions and discounts (25%) and menu selection (24%) were nearly tied for the sixth and seventh positions, reflecting their similar levels of importance to consumers.

At the lower end of the list, less significant drivers included nice ambience (10%), friendly staff (8%), loyalty or membership programs (5.2%), special items (5%), and free gifts (3%).

These findings underline the critical importance of delivering on the fundamentals—flavour, taste, and quality—for F&B marketers aiming to attract and retain customers. Strategies focused on promotions, loyalty programs, or free gifts may have less impact compared to ensuring consistently excellent food.

Reasons People Eat Their Favourite Brand Rankings:

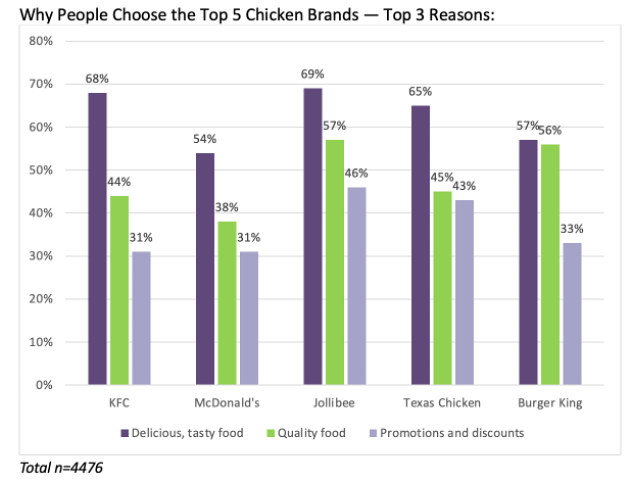

What Sets the Top Chicken Brands Apart? KFC, McDonald’s, Jollibee, Texas Chicken, and Burger King have solidified their positions as the top five chicken brands in five major cities, driven primarily by one key factor: delicious, tasty food.

A closer analysis reveals significant differences in how strongly this attribute is associated with each brand. While a majority of respondents associate delicious, tasty food with Jollibee (69%), KFC (68%), and Texas Chicken (65%), the percentages are notably lower for McDonald’s (54%) and Burger King (57%).

Jollibee further stands out for its strong associations with quality food (57%) and value for money (46%), underscoring its well-rounded appeal. Meanwhile, KFC’s popularity is notably enhanced by its focus on promotions and discounts (31%), which resonates strongly across the cities surveyed.

The chart below provides a detailed breakdown of these findings, showcasing the factors that drive preference for each of these leading brands.

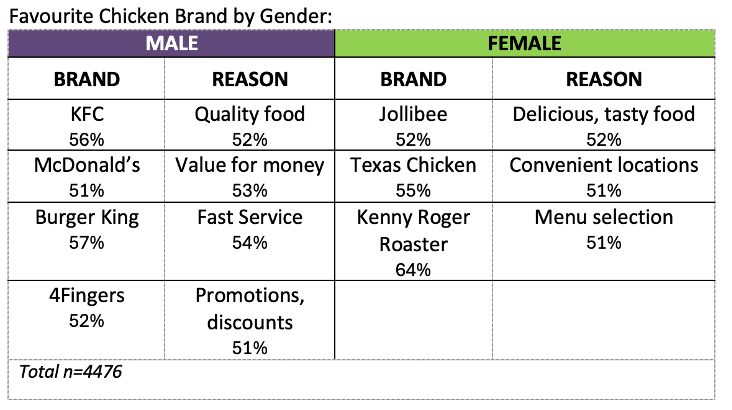

Gender Differences in Chicken Brand Preferences - When examining chicken brand preferences across five cities, notable variations emerge between male and female respondents, with equal weighting given to each gender.

- Male Preferences: Men show a stronger preference for KFC (56%), McDonald’s (51%), Burger King (57%), and 4Fingers (52%).

- Female Preferences: Women, on the other hand, favour Jollibee (52%), Texas Chicken (55%), and Kenny Rogers Roasters (64%).

The motivations behind these choices also differ by gender:

- Men tend to prioritize practical and efficiency-driven factors, such as quality food (52%), value for money (53%), fast service (54%), and promotions and discounts (51%).

- Women place greater emphasis on sensory and convenience-based elements, with delicious, tasty food (52%), convenient locations (51%), and menu selection (51%) ranking higher in their decision-making.

These insights into gender-specific preferences highlight the varying expectations and priorities of male and female consumers. A detailed chart below outlines these findings, offering a closer look at the drivers shaping brand loyalty across genders.

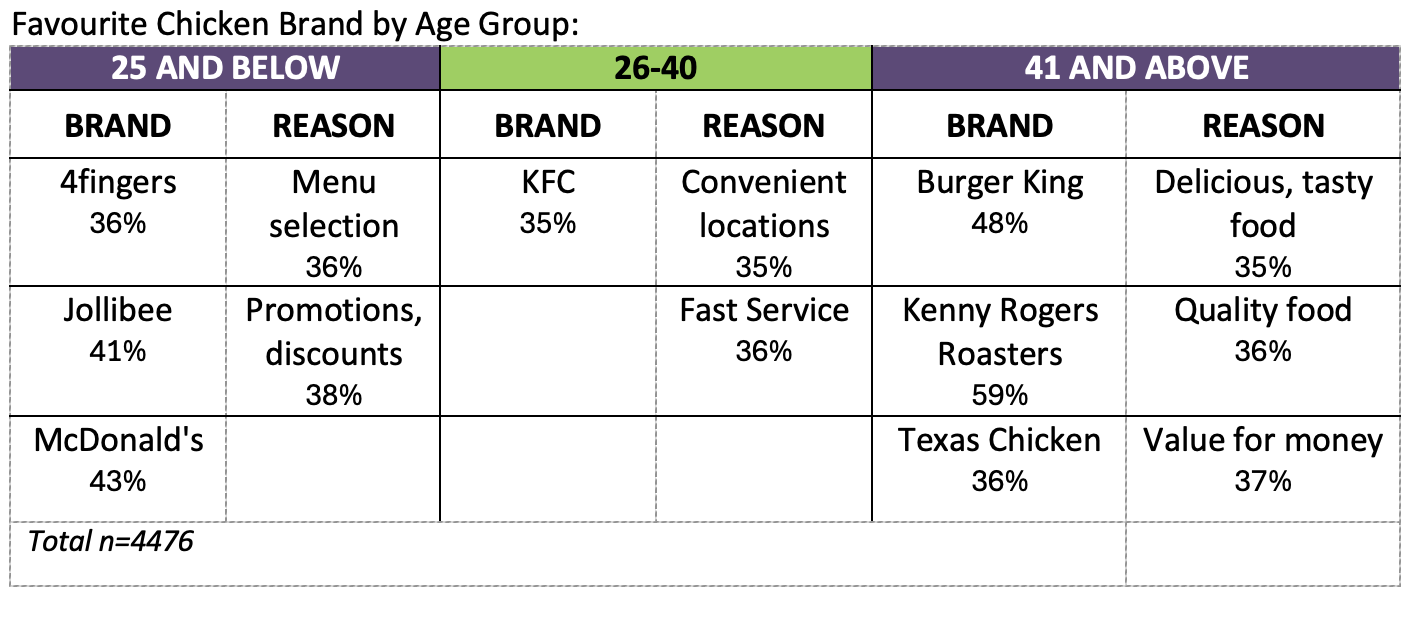

Age-Based Preferences for Chicken Brands: Chicken brand preferences vary significantly across age groups, with distinct priorities shaping the choices of younger, middle-aged, and older consumers. The analysis gives equal weight to three age segments: 25 and below, 26–40, and 41 and above, at 33.3% each.

- Younger Consumers (25 and below): McDonald’s (43%) stands out as the favourite among this age group, driven by its menu selection (36%) and promotions and discounts (38%). 4Fingers (36%) and Jollibee (41%) also attract younger individuals, reflecting their preference for variety and value-oriented offerings.

- Middle-Aged Consumers (26–40): KFC (35%) is the top choice for those aged 26–40, a group likely balancing busy working lives. This age segment prioritizes convenient locations (35%) and fast service (36%), aligning with their need for quick and accessible meal options.

- Older Consumers (41 and above): More mature individuals tend to have refined tastes, with a stronger focus on delicious, tasty food (35%) and quality food (36%). Their preferred brands include Burger King (48%), Kenny Rogers Roasters (59%), and Texas Chicken (36%), which resonate with their emphasis on premium flavours and dining experiences.

The chart below illustrates these age-specific trends, providing a comprehensive view of how preferences and priorities shift across generations.

Conclusion: Unpacking Chicken Brand Preferences Across Asia

This study reveals that while delicious, tasty food remains the universal driver of chicken brand loyalty, other factors such as quality, convenience, promotions, and menu variety play a significant role in shaping preferences across cities, genders, and age groups. From Jollibee’s stronghold among younger audiences to the appeal of KFC for busy middle-aged consumers, and the refined tastes of mature diners favouring brands like Kenny Rogers Roasters, the findings highlight the diversity of consumer priorities across the region.

As the food and beverage landscape continues to evolve, brands that adapt to these nuanced preferences will stand out in this competitive market.

For deeper insights into consumer behaviour and actionable strategies tailored to your market, connect with Illuminate Asia and the Asian Women Index. Our expertise in cultural and consumer insights can help your brand navigate and thrive in Southeast Asia’s dynamic markets. Contact us today on [email protected] to learn more about how we can support your business.