Introduction: As Southeast Asia’s tropical cities continue to grow and evolve, so too do the skincare routines of their residents. This study, part of the Asian Women Index in collaboration with Illuminate Asia, explores the skincare habits of over 1,500 individuals across Bangkok, Jakarta, Kuala Lumpur, Manila, and Singapore during October and November 2023. From hydration and sun protection to cleansing and beyond, the findings reveal fascinating trends and regional variations into how different demographic groups (gender, age, occupation) prioritize their skincare needs. Whether it’s the influence of climate, lifestyle, or cultural factors, the data sheds light on the skincare landscape and provides valuable insights for marketers.

Research Findings: When asked about their usage of 16 skincare product, residents in these five tropical cities claim to prioritize hydration and sun protection over cleansing. Moisturizers (58.9%) and sunscreens (58.5%) are the most used, followed by cleansers (57%). Serums rank fourth with 44% usage, significantly lower than the top three products. At the bottom of the list of products are the BB Creams (21%), Essences (19%) and lastly Exfoliators (18%). It appears that these Southeast Asians prefer a gentler treatment of their skin

Notable differences across city: Product usage varies notably across cities. In Manila (66%) and Kuala Lumpur (64%), staying hydrated is particularly important, while in Bangkok (53%), it seems somewhat less of a priority. Instead, Bangkok residents are more inclined to use sunscreen (73%), compared to Jakarta (59%) and Kuala Lumpur (57%). In contrast, Singaporeans with many airconditioned buildings, malls, trains and buses see much less need for sunscreen (49%)

Cleanser is the third most used skincare product among residents in these cities. In Kuala Lumpur, 64% of residents use cleanser, a rate higher than in Bangkok (58%), Jakarta (56%), Manila (55%), and Singapore (54%). This may suggest that concerns about pollution may drive a stronger emphasis on cleansing routines in Kuala Lumpur. Serum usage also appears higher in Bangkok, compared to other cities, with 3 in 5 claiming to use it.

Top 4 Most Used Skincare Product by City

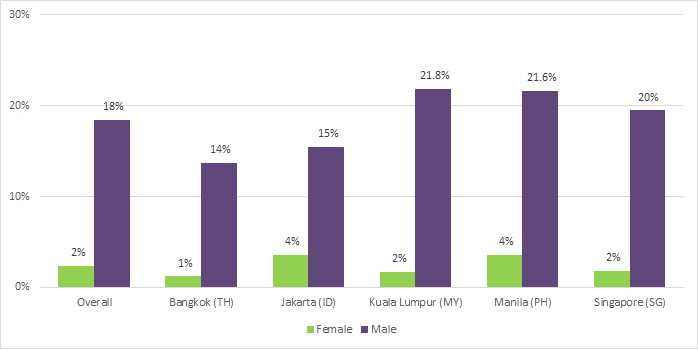

Notable differences by gender: As expected, we also note differences by gender. Less than 5% of women in these five cities do not use any skincare, with Bangkok having the lowest rate at just 1%.

On the other hand, 18% of men don't use any skincare products, including shaving cream, aftershave, or cleanser. The percentage of men who don't use skincare is similar in Kuala Lumpur (21.8%), Manila (21.6%), and Singapore (20%). In contrast, men in Bangkok are more attentive to their skincare routine, with only 14% not using any products.

The high engagement with skincare among both women and men in Bangkok suggests that this city is a particularly promising market for skincare products.

Skincare Usage Among Women and Men

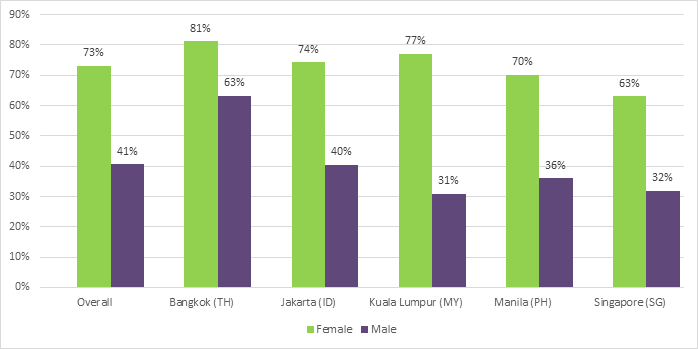

Sunscreen climbing to the top of the list: With growing concerns about climate change and environmental exposure, sunscreen is quickly becoming one of the top skincare products in these Southeast Asian cities. Analysing sunscreen usage by gender and city reveals insights that could be valuable to marketers

Overall, 73% of women use sunscreen, compared to 41% of men. Women in Bangkok lead with an 81% usage rate, while women in Singapore are the least likely to use sunscreen, at 63%. Among men, those in Bangkok also top the chart at 63%, while only 31% of men in Kuala Lumpur and 32% in Singapore use sunscreen.

Sunscreen Usage by Gender

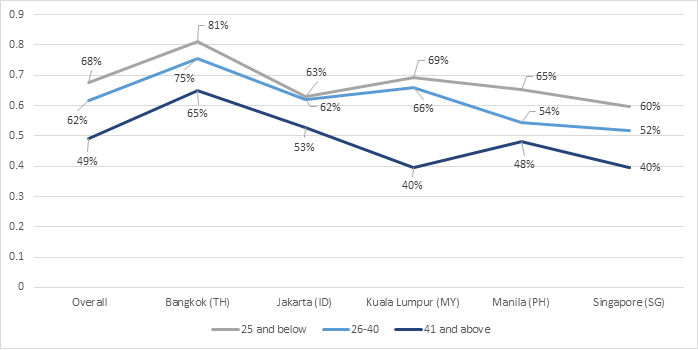

Sunscreen usage by age: Interestingly, it’s the younger generation, not older individuals, who prioritize protecting their skin from the sun to maintain a fair and freckle-free complexion. In fact, 68% of people aged 25 and below use sunscreen, compared to just 49% of those aged 41 and above. This indicates that younger individuals are more concerned about sun exposure.

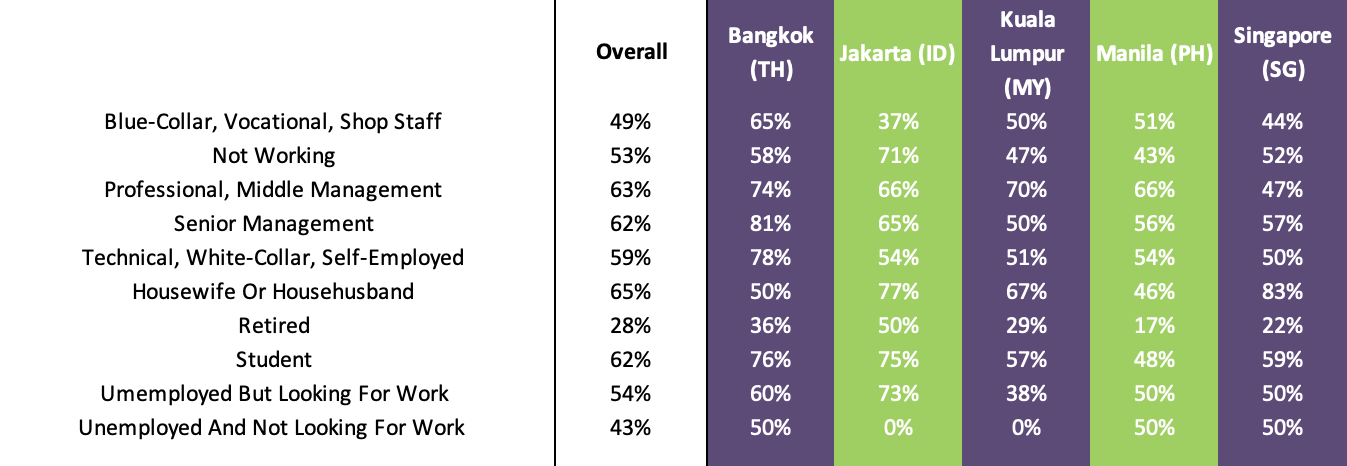

Sunscreen usage by occupation: Contrary to what one might expect, it’s not outdoor workers who are most concerned about sun exposure. Instead, individuals in professional, middle management, and senior management roles show greater awareness, with approximately 63% of them regularly using sunscreen. Another interesting finding is the high rate of sunscreen usage, 71%, among those not working in Jakarta. Specifically, 77% of housewives and househusbands and 75% of students in this group prioritize sun protection. However, it’s worth noting that only 28% of retired individuals use sunscreen, which aligns with the broader trend of people aged 41 and older being less concerned about sun exposure.

Sunscreen Usage by Age

Sunscreen usage by Occupation

Conclusion: In conclusion, the skincare habits of residents across these five Southeast Asian cities reveal a clear preference for hydration and sun protection, with moisturizers and sunscreens leading the list of most-used products. However, notable differences emerge when analysing usage across cities, genders, and occupations. Bangkok residents, for example, demonstrate a particularly high engagement with skincare in general, but particularly sunscreen, reflecting broader concerns about environmental exposure. The data also highlights a significant generational divide, with younger individuals being more proactive in protecting their skin from the sun compared to their older counterparts.

These insights suggest that while the fundamentals of skincare—hydration and sun protection—are universally valued, marketers should consider the specific needs and behaviours of different demographic groups and geographies when developing and promoting their products. The emphasis on sun protection, especially among younger and more professional segments, underscores the growing importance of addressing climate-related concerns in skincare routines.

For brands and businesses looking to deepen their understanding of Southeast Asian consumers, partnering with Illuminate Asia and the Asian Women Index offers an opportunity to uncover even more nuanced insights. By tapping into their expertise and research capabilities, you can gain a competitive edge in navigating these dynamic and diverse markets. Reach out to Illuminate Asia today to explore how we can work together to unlock the full potential of these emerging consumer trends.